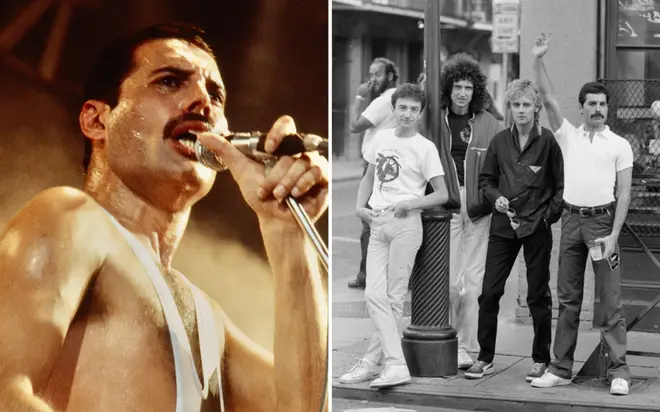

Queen reportedly closing on $1.2 billion sale of their music catalogue

19 February 2024, 12:08

Listen to this article

They're about to break a major record.

And fans of legendary rock band Queen will feel it's justified, as they prepare to sell their music catalogue for over a billion dollars.

During the pandemic, some of the most influential artists to ever grace our radios began selling over their life's work for a hefty sum.

The likes of Bruce Springsteen, Bob Dylan, Cher, Stevie Nicks, Blondie and John Legend parted with the rights to their songs, with Rod Stewart becoming the most recent to trade in his music for mounds of money.

- Queen's greatest music videos: Brian May breaks down band's biggest hits

- When Freddie Mercury admitted there was "nothing else left" between him and Queen bandmates

- Listen to Queen's poignant rendition of 'Imagine' only days after John Lennon's death

- When Freddie Mercury 'married' Bond girl Jane Seymour with George Michael, Madonna and others watching on

Now British rock legends Queen are following suit, in what would mark a record-shattering sale if the mooted figure agreed goes through.

It'll defy the tumbling fees for music legend's catalogues that have slumped since the pandemic, with Queen's sale more than doubling the current record set by Springsteen who sold his rights for $550 million in 2021.

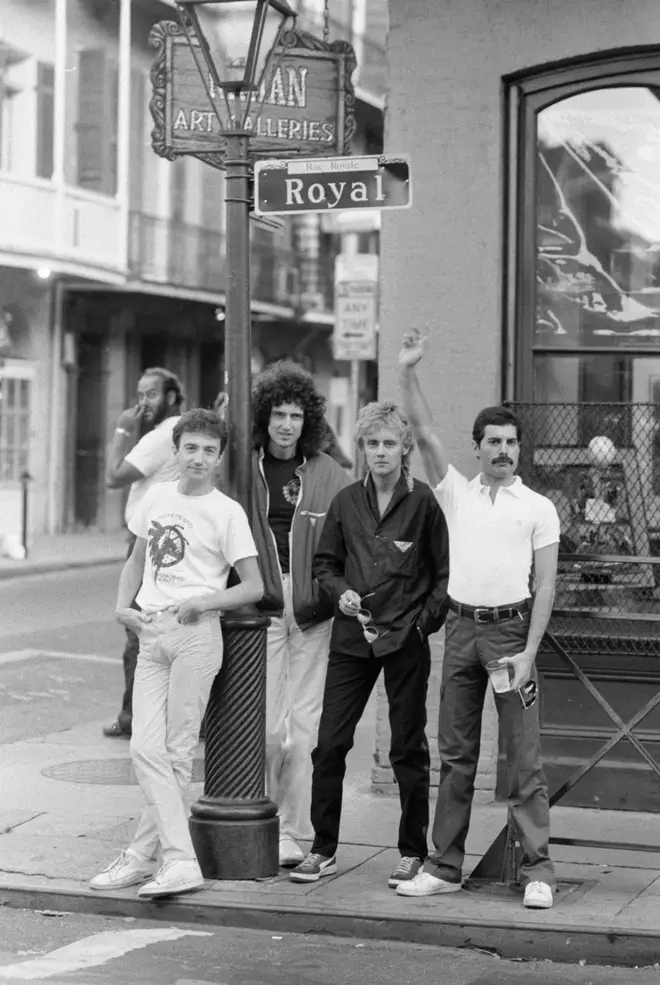

Queen's surviving band members Brian May, Roger Taylor and John Deacon are in advanced talks with Freddie Mercury's estate to sell their rights for an eye-watering sum.

There's a difference between the 'master' copyright and the 'publishing' copyright - the former means you have the rights to the recording, and the latter means you have rights to the lyrics and the music.

To make matters slightly more confusing, is that Disney Music Group owns the North America rights to Queen's music, though the band retain ownership of the global rights via Queen Productions Ltd, their UK-based company which earned £39 million in royalties in 2021.

The fee for an artist's music catalogue is based on the annual returns investors can make from usage of their music.

Leading music lawyer Guy Blake, who has himself worked on these kinds of acquisitions told DailyMail.com that the Queen deal would be "seismic" if it went through.

"In general, I don't see a problem with this [$1.2 billion] number being accurate, I think there's probably some degree of truth to it."

"There aren't a whole lot of catalogues out there like Queen," saying that sales wouldn't likely match this again. "I think you've seen the market build to a crescendo and now it's starting to drop slightly," he added.

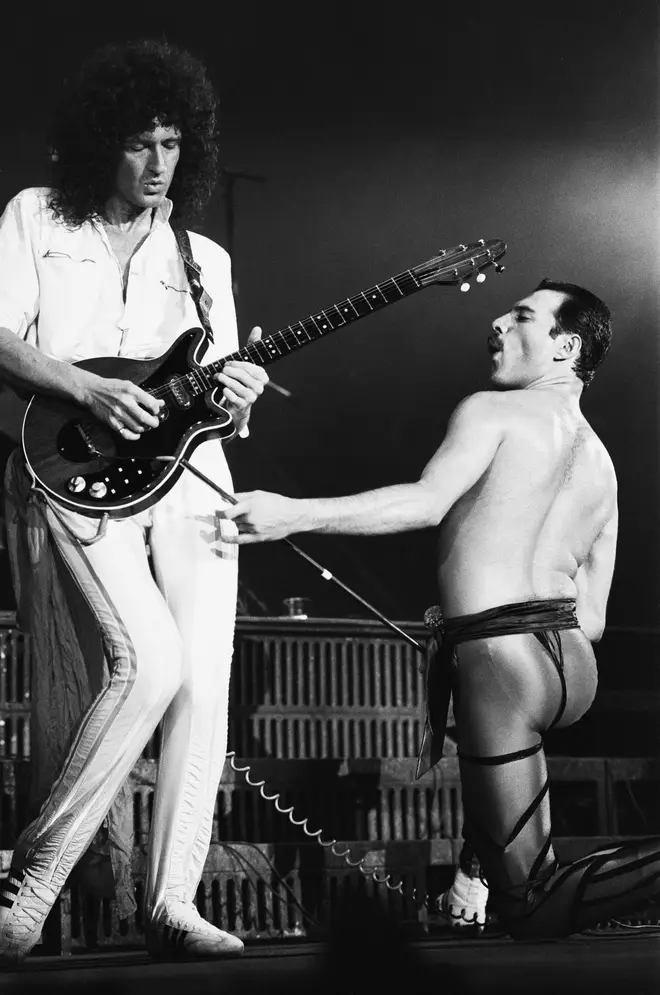

Though the appeal of Queen's music has endured throughout the thirty plus years since Freddie Mercury's death, they were on the end of a resurgence in 2018.

Thanks to Rami Malek's Oscar-winning turn as Freddie in biopic Bohemian Rhapsody, streaming figures for tracks like 'We Will Rock You', 'Radio Ga Ga', 'Bohemian Rhapsody' and 'I Want to Break Free' boomed again.

"Queen has found a much younger audience. And that's unique to a legacy catalogue, Blake said.

"I don't know that there's a whole lot of rock bands out there that could say that they had the popularity with people under 30 that Queen has right now."

"There's just some uniqueness to so many of their songs that they just keep coming back, generation after generation."

Blake summed it up: "If you tell any private equity company 'hey, we think we have a chance to buy Queen', they'll find the money."